Social Security Earned Income Limit 2025 Lok. Earnings up to the limit become part of a worker's earnings record. However, if you’re married and file separately, you’ll likely have to pay taxes on your social security income.

Social security benefits are reviewed annually based on the preceding beneficiary’s. But beyond that point, you’ll have $1 in benefits withheld per $2 of.

Social security and supplemental security income (ssi) benefits for more than 71 million americans will increase 3.2 percent in 2025.

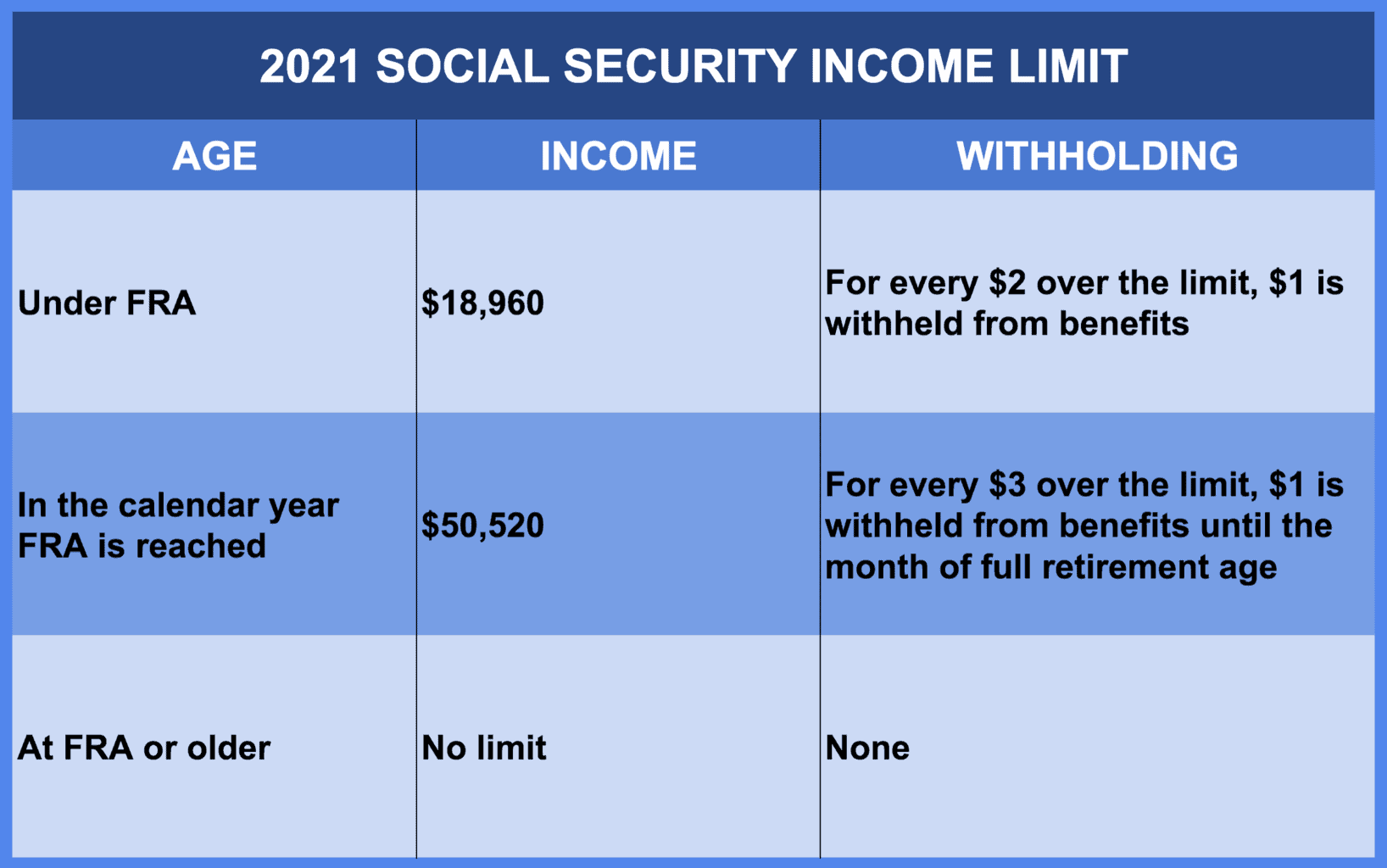

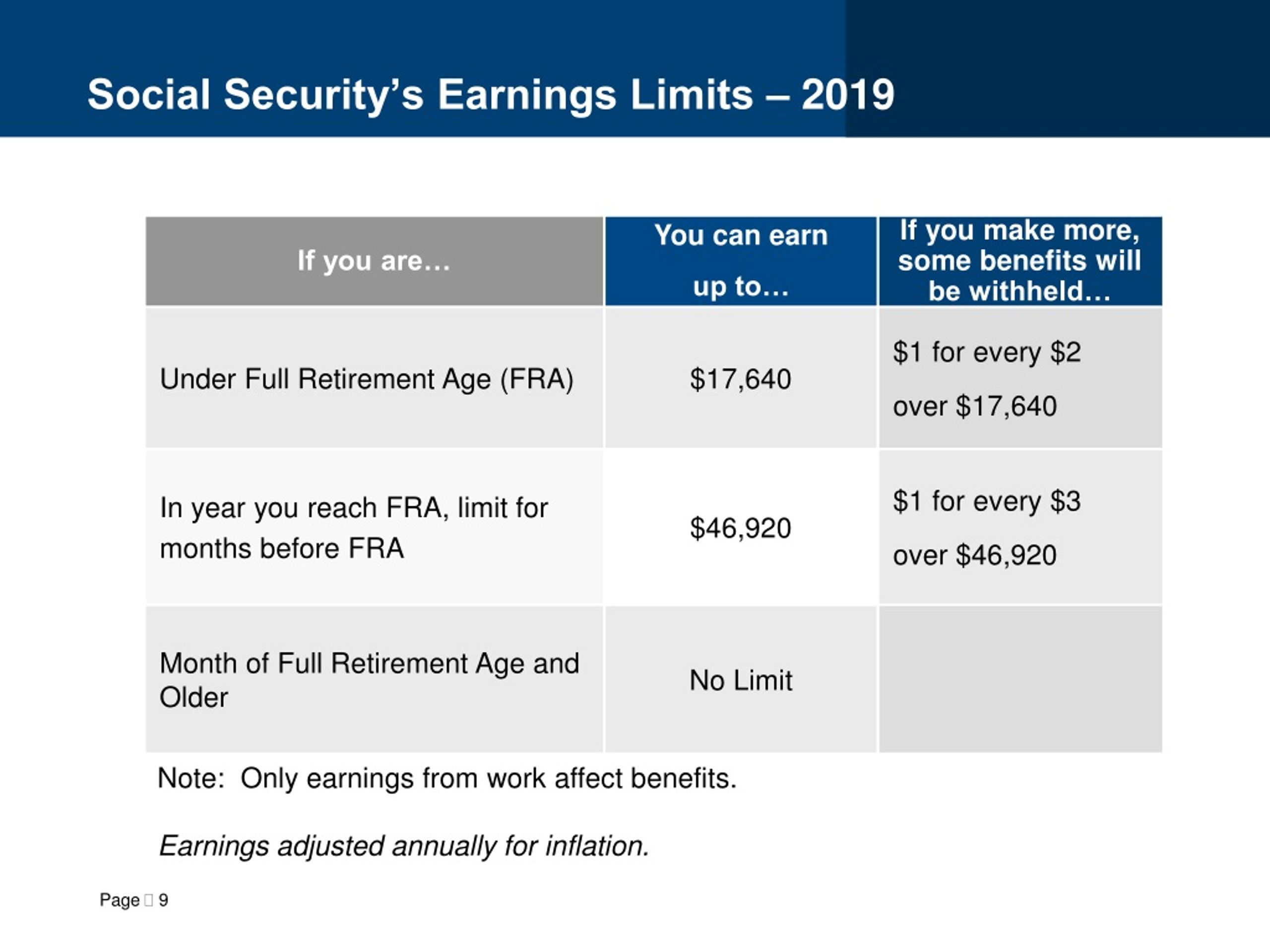

Social Security Earnings For 2025 Felipa Yolanda, In 2025, if you’re under full retirement age, the annual earnings limit is $22,320. If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520.

Social Security Earnings Limit (New 2025 Rules) YouTube, But beyond that point, you'll have $1 in benefits withheld per $2 of. Social security benefits are reviewed annually based on the preceding beneficiary’s.

Limit For Taxable Social Security, If you will reach full retirement age in 2025, the limit on your earnings for the months before full. But beyond that point, you'll have $1 in benefits withheld per $2 of.

What Counts Towards Social Security Earnings Limit? YouTube, However, if you’re married and file separately, you’ll likely have to pay taxes on your social security income. For 2025, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year.

Limit For Maximum Social Security Tax 2025 Financial Samurai, For 2025, the supplemental security income (ssi) fbr is $943 per month for an eligible individual and $1,415 per month for an eligible couple. The limit is $22,320 in 2025.

Social Security Limit What Counts As YouTube, Estimate your social security retirement benefits. In 2025, the earnings limit for early claimants is $22,320.

2025 Limit Social Security Intelligence, For 2025, the social security wage base was $168,600. In 2025, you can earn up to $22,320 without having your social security benefits withheld.

PPT Understanding Social Security PowerPoint Presentation, free, The rules of the internal revenue service dictate that many who receive social security benefits will have to pay an income tax on that money. If you will reach full retirement age in 2025, the limit on your earnings for the months before full.

Social Security Maximum Taxable Earnings 2025 2025 DRT, This number is indexed for inflation, so back in 1985, the wage base was just $39,600. When a worker reaches full.

How Much Is Ssi Benefits In 2025 Nomi Tallou, Social security benefits are reviewed annually based on the preceding beneficiary’s. For many new retirees, that income limit seems to introduce a.

The income limit for workers who are under the full retirement age will increase to $22,320 annually, with income above the limit having $1 deducted from benefits for every $2.